Demystifying the Insurance Renewal Process: Eight Key Points

1. The commercial insurance renewal is the continuation of ONE part of your institution’s risk management process.

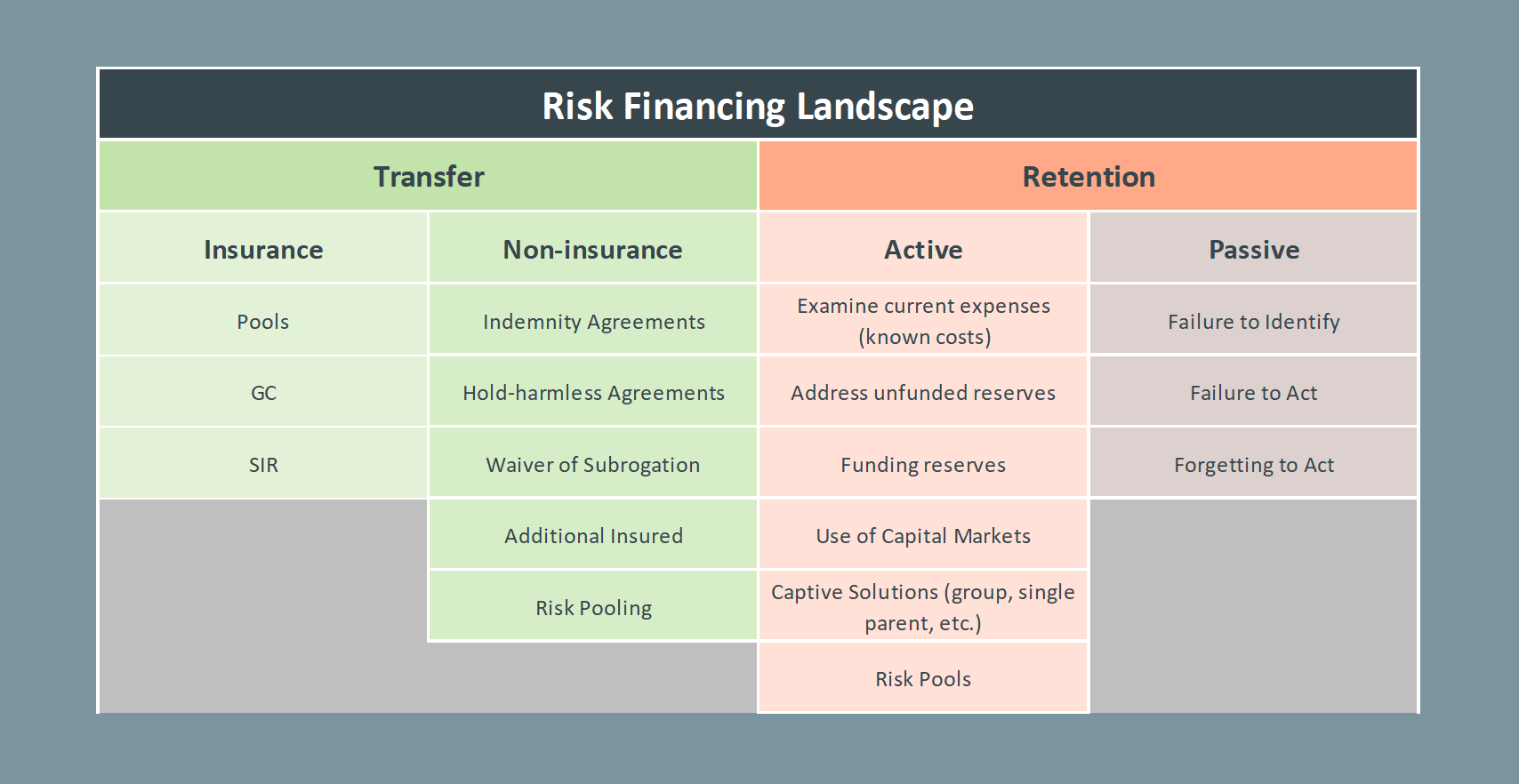

The decision to purchase and renew commercial insurance is contingent upon effective and ongoing identification, analyses, and control of institutional risks, at which point, the decision to finance the risk through one method of transfer (insurance) results in the selection and procurement of specific lines of commercial insurance coverage.

Your insurance renewal is simply the continuation of the contractual agreements between you and the insurance carrier to transfer risk that your institution has decided it cannot fully control, mitigate, or retain. The cost of this risk transfer and associated retention (i.e., the resulting insurance premiums and their respective deductibles) are only two of the components that make up your institution’s total cost of risk. Other factors to consider include departmental changes, outside services, and unplanned direct and indirect costs to the institution.

2. Insurance carriers need a full understanding of the risk they are assuming.

The more unknowns there are with respect to your institution’s property, human resources, liability, and budget containment risks, the worse the renewal outcome will be, which will be reflected in both your renewal pricing (think cost increases) and the value of the commercial lines of coverage offered (either through reduced limits of coverage, or potential exclusions for the types of events that the carrier is willing to assume through transfer of risk).

3. Insurance agents and underwriters are people too, and insurance is a partnership built on trust.

Commercial insurance (especially the renewal process) is a person-to-person, business relationship. A reciprocally proactive (key word) long-term partnership with your carrier/underwriter and agent/agency will yield great dividends with respect to value added and cost savings for your institution’s commercial insurance coverages when each party is properly viewed in this manner.

4. Risk control and mitigation have a direct impact on your premiums and availabilities of coverage.

Proper risk control and mitigation ultimately reduces the overall risk for both your college and the overall risk that the carrier is assuming via risk transfer (insurance). Think back to the intended purpose of insurance coverage: your institution is transferring a risk otherwise deemed internally unmanageable to an insurance carrier. That carrier is assuming your risk, for an agreed upon price. When you effectively control and mitigate institutional risks through adherence to effective policies and procedures, non-insurance risk transfer agreements, retention methods, disaster recovery, litigation management, and claims management processes, the risk that the carrier is assuming is reduced. These risk management methods, when effective and adhered to, make your institution’s risk more appealing to carriers and underwriters. This has direct bearing on your institution’s insurance premium, and the amount of coverage that carriers are willing to provide.

5. When an underwriter receives an insurance renewal submission, that is all they know about your institution.

A basic submission made up of applications, claims history, basic policies and procedures, and a brief narrative is barely a submission. In order to fully tell your institution’s story, it is important to go above and beyond the basic information that is requested. A “top-of-the-stack” submission should include the following items:

- An in-depth institutional narrative

- Explanations for all claims alongside deep dives into control and mitigation strategies

- Up-to-date property photos and catalogued property schedules

- Leadership team CV/resumes

- Institutional awards and honors

- Client/Student testimonials

- Plans for future growth or change

- Safety committee meeting agendas/meeting minutes

- Policies, programs, procedures: going above and beyond the minimum requirements

The submission is the full story of your institution. The more you can “bring to life” your organization and the more information you can provide the carriers/underwriters, the better your story will be, which will be reflected in the renewal terms and pricing.

6. Your institution’s insurance agent or producer serves as the mediator between your institution and your carrier/underwriter.

As such, the agent’s role in the renewal is two-fold:

- To present your institution as an indispensable account to the carriers/underwriters; and,

- To help facilitate a seamless renewal and long-term carrier partnership.

Procuring your institution’s insurance terms and coverages is the bare minimum; it is merely the blocking and tackling. A renewal that has not been proactively marketed to assess competitiveness across carriers is a missed opportunity for your institution, with the realization that the incumbent carrier should be given first consideration for your institution’s continued business. Remember, insurance is a relationship business. It is the agent’s or producer’s responsibility to set renewal submission standards high enough to justify the incumbent carrier’s continued interest in your institution as a prioritized account. Doing so keeps all parties honest:

- On the institution side, establishing high submission standards and process standards sets the table for value-added coverages and premium cost-savings without threat of gaps or lapses in coverage.

- On the producer/agent side, proactive advocacy with incumbent carriers and intentional coverage placement with more competitive carriers who are willing to fight for your institution’s business becomes the expectation, rather than the exception to the rule at renewal time.

- Given proactive approaches to the renewal by both the institution and producer, on the carrier/underwriter side, consideration for your institution as an indispensable account, reflected in both competitive pricing and value-added coverage, is the natural response.

7. Adherence to renewal process best practices, inclusive of an agreed upon renewal timeline, guarantees proper consideration of your institution by interested carriers.

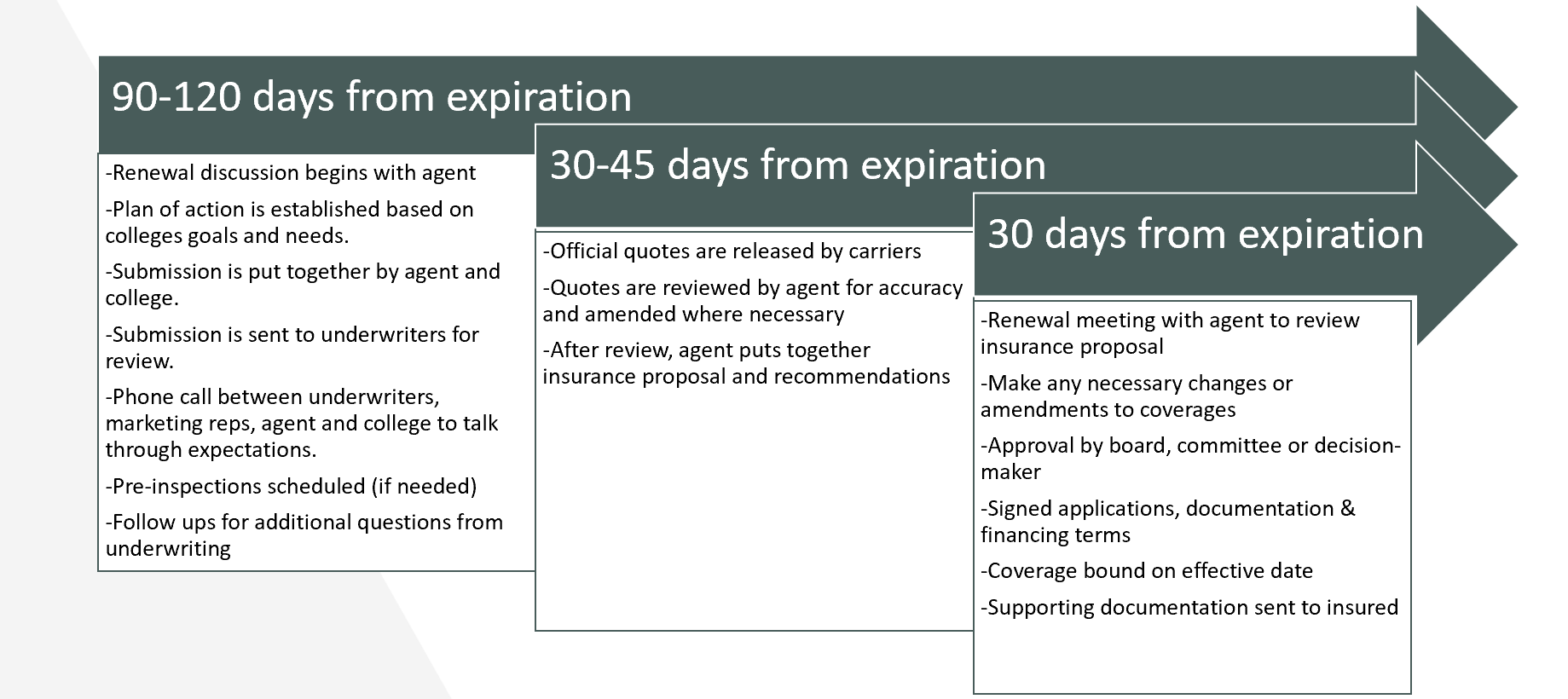

Effective insurance renewal processes begin between three to four months out from each policy’s expiration date and start with a joint meeting to discuss and prepare an agreed upon game plan. Renewal pricing indications may be received by your institution prior to 45 days from an expiration date from certain carriers, but many carriers will release quotes between 30 and 45 days prior to your renewal. It is critical to review your renewal proposal 30 days prior to each current policy expiration to ensure satisfaction. This is your institution’s opportunity to hold the producer/agent accountable to properly serve and service your account. Creating a stewardship assessment report is a good way for your institution and producer/agent to level-set about agreed upon services and the timing of those services throughout the policy year. The final proposal and review of insurances should be delivered 30 days (one month) in advance of each policy’s effective date to ensure that any changes or requests made by the institution can be addressed or performed by the producer in a diligent and timely manner.

8. Your institution’s goal should be to become a marquee, “top-10” account for the carrier and underwriter.

As previously discussed, when the carrier reviews their book of business, they should always have your institution at the top of their list for retention. This can be achieved by consistent provision of “top-of-the-stack” submissions, adherence to renewal process cadence best-practices (120-90 days process/45-30 days process/30-0 days process), and committing to long-term, proactive agency/producer and carrier/underwriter partnerships.

About this Article and Author: “Demystifying the Insurance Renewal Process” is the first of a four-part ABACC webinar/article series dedicated to assisting HR and Finance officers of Christian Postsecondary Institutions navigate the nuances and complexities of commercial insurance. As Christian Risk Advisors, the intended purpose of each webinar is, simply put, to equip the saints. Each installment’s aim is to provide a contextual framework, descriptive detail, and some helpful takeaways, for a digestible glimpse of insurance and risk management processes from multiple angles. In response, financial decision-makers of Christian institutions will be able to take a more proactive and involved approach to insurance decision-making, grounded in understanding and accountability. General or specific questions about topics within this article, the webinar series, or commercial insurance renewals can be directed to Eric Price or by clicking on the Atlas Insurance Agency banner ad within this article. We look forward to continuing to serve ABACC’s member institutions, and God bless.

Eric Price, CSRM, MPP

Christian Risk Advisor

Michael Howard, CRM, CIC, CWCS

Christian Risk Advisor